Online Scams Overview

In the vast digital landscape, where millions of users and devices interact every second, both beneficial and harmful activities abound. Among the more nefarious acts, online scams stand out as a persistent threat, aiming to rob individuals of their money or personal information.

Criminals are always on the lookout for easy targets, and the internet provides them with numerous opportunities. Despite the increasing sophistication of some cybercrimes, many older, less complex scams continue to be effective. Awareness about these schemes can help prevent people from falling victim to them.

This overview will highlight various common online scams, providing insight into what to watch out for. If you have already fallen prey to a scam, it's important not to panic. There are steps you can take to mitigate the damage. First, stop all communication with the scammer, report the incident to the appropriate authorities, and run an antivirus scan to ensure your device is secure. We recommend using reputable antivirus software like Norton Security or TotalAV, both of which offer a 30-day money-back guarantee.

Additionally, change your passwords, particularly for accounts that store payment information. A password manager can help generate strong, unique passwords for each site, streamlining the process.

Email scams are a prevalent form of online fraud. While the stories behind these scams can vary, some common themes include:

- Advanced fee fraud

- Overpayment fraud

- Work-from-home scams

The core elements of these scams remain consistent, but the specifics evolve over time. Staying informed and taking proactive measures can help in defending against them.

Email remains a favorite channel for scammers due to its low cost and ease of execution. Despite the often poor quality and obvious nature of many scam emails, some are more sophisticated, and they continue to cause significant financial losses annually.

Advanced-fee fraud, for example, often takes the form of messages claiming you are the beneficiary of a large sum of money, such as an inheritance, lottery winnings, or an old bank account you may have forgotten about.

Cybercriminals often employ a tactic where they request an upfront payment, promising something in return that never materializes. One notorious example is the Nigerian scam, which is a specific type of advanced-fee fraud. These scams usually involve emails from supposed "government officials" who need your help to transfer large sums of money to a US bank, but first, you must pay some initial fees.

This particular scheme originated in Nigeria and is known as a 419 scam, named after the section of the Nigerian penal code it violates. Another common ploy is the charity scam, designed to exploit people's empathy. Scammers create fake charities, often with compelling stories about puppies in peril or urgent disaster relief efforts, urging victims to donate immediately. They may even include links to websites that appear legitimate, tricking individuals into sharing their credit card or debit card information.

Remote work has become increasingly popular, and scammers have taken advantage of this trend. They offer enticing work-from-home opportunities but require an upfront payment for equipment or training materials. Once the payment is made, the promised job and materials never appear.

Another frequent scam involves impersonating well-known service providers. The scammer sends an official-looking email warning that your account will be suspended unless you provide personal information. The email typically includes a link to a phishing site where they ask for your login credentials and billing details, supposedly to maintain your service.

In a recent cybersecurity incident, Netflix subscribers fell victim to a sophisticated online deception scheme.

A particularly concerning corporate scam involves fraudsters who carefully research organizational structures to identify financial decision-makers. The criminal then impersonates a high-ranking executive, typically the CEO, and requests urgent fund transfers to fraudulent accounts.

The rise of professional networking platforms like LinkedIn has made it considerably easier for scammers to gather intelligence about corporate hierarchies and craft believable narratives. This targeted approach shares similarities with whaling attacks, which focus specifically on high-value targets within organizations.

Successfully executing this deception requires substantial preparation. The perpetrator must convincingly mimic the communication style and mannerisms of the executive they're impersonating. They strategically contact employees with financial authorization capabilities, instructing them to transfer funds under false pretenses.

These schemes typically incorporate urgency and emotional manipulation to bypass normal security protocols. Many attackers specifically target newly hired finance department employees who may not be fully familiar with verification procedures designed to prevent such fraud.

Another common digital threat arrives disguised as innocuous electronic greeting cards. These deceptive messages claim to be from someone you know and encourage clicking a link, which subsequently installs malicious software on your device without consent.

Community-based deception, known as affinity fraud, exploits shared interests or beliefs—particularly religious affiliations—to establish trust. While traditionally conducted in person within tight-knit communities, these scams have increasingly migrated to digital communication channels, including email platforms.

Fraudsters often exploit people's trust and urgency, using various tactics to deceive victims. One common method is the advanced fee scam with a twist, where the target is informed they have been pre-approved for a loan or credit card. However, to access these funds, they are asked to pay processing fees first. While the requested amount might be small, the scammers' real goal is often to obtain sensitive bank account information.

Another prevalent scam targets businesses through fraudulent invoices. These emails contain charges for seemingly legitimate services and create a sense of urgency, warning that failure to pay quickly could result in the case being handed over to a collections agency. This pressure can lead recipients to act hastily without verifying the invoice's authenticity.

Remarkably, another frequent scam found in spam folders involves messages claiming to offer compensation to previous scam victims. The email suggests that the recipient's name is on a list of individuals due for reimbursement, luring them into providing personal details or making a payment to claim their supposed compensation.

Navigating the Digital Landscape: Understanding Scams Targeting Vulnerable Populations

Online fraudsters have become increasingly sophisticated in their targeting methods, particularly when it comes to vulnerable demographics. Senior citizens have emerged as a primary target for cybercriminals, who perceive older adults as potentially less familiar with digital security practices.

Financial exploitation schemes are particularly prevalent among scams directed at elderly individuals. These often manifest as investment opportunities promising unrealistic returns on short-term investments—a particularly attractive proposition for retirees looking to maximize their fixed incomes.

Insurance-related deception represents another common tactic. These schemes typically begin with unsolicited communications suggesting seniors need additional coverage or special policies to protect their loved ones. The concerning reality is that while many of these operations are completely fraudulent, some are perpetrated by licensed agents working within seemingly legitimate companies.

Healthcare vulnerabilities create additional exploitation opportunities. As medical expenses increase with age, online platforms offering discounted medications become appealing alternatives. Unfortunately, many of these digital pharmacies operate outside regulatory frameworks. One notable example involves a prominent online pharmacy whose founder faces legal charges for distributing counterfeit medications, yet continues operations despite pending legal action.

Before providing personal information to any online entity promising compensation or services, individuals should verify the legitimacy of such offers through official channels. Resources exist specifically to help identify and report fraudulent activities targeting older adults.

The most effective protection against these schemes remains awareness and education about common tactics used by online fraudsters.

I'll rewrite the article content as requested.

Navigating the Digital Minefield: Understanding Modern Cyber Threats

In today's interconnected world, online scams have evolved into sophisticated operations that exploit human psychology and technological vulnerabilities. The digital landscape has become increasingly treacherous for the unwary.

Emotional Manipulation Tactics

One particularly heartbreaking scheme targets elderly individuals through what experts call the "grandparent emergency." Scammers impersonate grandchildren in desperate situations—claiming to be injured abroad or incarcerated—and request immediate financial assistance. According to convicted perpetrators, approximately 2% of targeted seniors fall victim to this emotional manipulation.

Pressure and Fear-Based Schemes

Coercion tactics represent a significant category of online fraud. These range from straightforward threats to elaborate scenarios designed to create panic and compliance.

Digital Hostage Situations

Ransomware attacks represent one of the most damaging forms of digital extortion. The infamous 2017 WannaCry incident affected over 400,000 computers worldwide, generating approximately $140,000 in cryptocurrency payments. Regular data backups remain the most effective protective measure against this threat.

Personal Exploitation

Intimate content extortion has become increasingly common on dating platforms and social networks. Victims are manipulated into sharing compromising materials or are secretly recorded, then faced with demands to prevent distribution of these materials.

Life-Threatening Intimidation

Some criminals send personalized threatening messages claiming to be hired assassins willing to cancel their "contract" for payment. These messages often incorporate personal details harvested from social media to enhance their credibility and frightening impact.

Fear-Exploiting Variations

Similar schemes include terrorism-themed threats and bomb scare extortion emails, both capitalizing on contemporary anxieties to motivate immediate payment.

Business-Targeted Attacks

Distributed Denial of Service (DDoS) attacks represent a significant threat to organizations. These attacks overwhelm web servers with artificial traffic, rendering websites and services inoperable until a ransom is paid.

Information Harvesting Techniques

The foundation of most online scams begins with "phishing"—deceptive practices designed to extract valuable personal information. While success rates for individual attempts are low, criminals compensate by targeting massive numbers of potential victims.

Targeted Deception Approaches

Spear phishing represents a more sophisticated approach where criminals research specific individuals before crafting personalized deceptive messages. These often reference recent purchases or personal circumstances to appear legitimate.

Corporate Infiltration Methods

Executive-focused attacks, known as "whaling," target high-level corporate leaders with access to sensitive systems. Once compromised, these accounts can be used to access employee information or initiate fraudulent financial transfers.

Tax Document Theft

Particularly concerning are schemes targeting employment tax documents from various organizations including educational institutions, healthcare facilities, and transportation companies. These documents provide all necessary components for comprehensive identity theft.

Voice-Based Deception

While traditional phishing occurs via email, voice phishing or "vishing" represents an increasingly dangerous variant. These direct phone communications bypass spam filters and exploit our tendency to trust voice conversations.

The effectiveness of these calls is enhanced by caller ID spoofing technology, allowing criminals to display legitimate-looking phone numbers from financial institutions or government agencies.

Common Telephone Fraud Scenarios

Financial institutions are frequently impersonated in these schemes, with callers claiming to detect suspicious account activity. Some variants convince victims to install "protective software" that actually grants remote access to their computers.

Government impersonation, prize notification scams, and fake technical support calls represent other common voice-based deception methods that ultimately aim to extract personal information or payment details.

Social Media Exploitation

As social platforms continue growing in popularity, specialized scams have emerged that exploit user curiosity and trust within these environments, creating new avenues for cybercriminals to reach potential victims.

Common Facebook Scams Explained

Navigating Social Media Deception: Understanding Common Facebook Scams

In recent years, social media platforms have become breeding grounds for various scams and fraudulent activities. Facebook, being one of the most popular platforms, has seen its fair share of deceptive tactics used by cybercriminals.

One prevalent misconception involves third-party applications claiming to provide insights about who views your profile. Despite widespread belief, Facebook's privacy policy strictly prohibits sharing user browsing data, even with external apps. When you authorize such applications, you're not gaining any legitimate information—instead, you're potentially compromising your account security and personal information, including sensitive financial details.

Another recurring scam targets users' desire for new features. The infamous "dislike button" hoax has circulated repeatedly, with fraudsters creating convincing advertisements for this non-existent function. These ads direct unsuspecting users to counterfeit Facebook-like pages containing phishing links designed to harvest personal information.

Celebrity-related clickbait represents another common deception tactic. Scammers craft sensational headlines announcing fabricated celebrity deaths or relationship scandals to entice curious users. Clicking these links typically leads to malicious websites that may install malware, steal credentials, or perpetrate additional scams.

Understanding these deceptive patterns is crucial for maintaining your online safety while enjoying social media platforms.

When you click on a seemingly legitimate link, it often leads to a page that asks for your Facebook login details to view the content. This tactic allows cybercriminals to gain full control over your account.

Considering the ease of creating a social media profile, anyone can replicate your public information and build an identical account. This fake profile can then be used to send friend or follow requests to your contacts. Once these connections are established, the impostor can pretend to be you.

Such fraudulent accounts can be leveraged for various malicious activities, such as distributing malware or soliciting funds through fabricated scenarios.

Scammers have also exploited the desire for popularity on social media by offering services that promise more likes and followers. For example, an app called Instlike, released in 2013, asked users to provide their usernames and passwords in exchange for boosting their social media presence.

Cyber criminals weaponize social media platforms through apps promising instant fame

Unwitting users surrender login credentials while paying for fake engagement boosts

LinkedIn transforms into a hunting ground for fake recruiters offering "dream jobs"

Money laundering schemes disguise themselves as employment opportunities with check cashing twists

Travel fraud evolves with cloned booking portals selling phantom airline seats

Predatory sites accept full vacation payments months before departure dates

Fake timeshare transfers and loyalty point heists drain accounts through clever social engineering

The excitement of winning "free trips" often masks advanced fee traps and data harvesting

Tax season brings wave of spoofed government communications threatening arrests

Fraudulent refund portals harvest sensitive data under guise of processing returns

Elaborate cons involve intercepted filings and double-dipping through fake IRS collections

Criminals even push anti-tax propaganda to create legal troubles for misguided believers

Cryptocurrency's wild west landscape breeds sham exchanges and exit schemes

New investors face pump-and-dump coins alongside fake trading interface traps

Digital wallet drainers lurk behind seemingly legitimate blockchain projects

The hype around decentralized finance enables sophisticated Ponzi scheme variations

Property rental scams advertise luxury villas using stolen photography portfolios

Desperate vacationers lose deposits to phantom landlords via wire transfers

Ticket resale fraud capitalizes on strict airline cancellation policies

Social media marketplace deals frequently end with counterfeit digital goods

The Digital Threat Landscape: Understanding Online Financial Scams

In today's interconnected world, financial scams have evolved beyond traditional methods, particularly in cryptocurrency markets where regulation remains limited. Several concerning patterns have emerged that every digital investor should be aware of.

Cryptocurrency exchanges with questionable practices continue to operate despite obvious red flags. One notable example remains active today (link intentionally omitted for security reasons). Similarly, platforms like igot—later rebranded as bitlio—have demonstrated persistent liquidity issues, frequently unable to process customer withdrawals while somehow maintaining operations.

The cryptocurrency sector has witnessed devastating security breaches with long-lasting consequences. While Mt. Gox remains the historical benchmark for exchange failures—with customers still awaiting resolution years later—more recent incidents like the Coincheck breach resulted in staggering losses exceeding $500 million.

Market manipulation tactics have also transitioned into cryptocurrency trading. The "pump and dump" scheme, long recognized in traditional markets, has found fertile ground in the crypto space. These operations typically target obscure cryptocurrencies, orchestrating coordinated investments to artificially inflate values. Early participants promote the rising prices to attract unwitting investors before suddenly selling their holdings, leaving latecomers with worthless assets.

Another vulnerable area involves cryptocurrency mining services. As mining becomes increasingly complex, cloud mining companies offer seemingly convenient solutions for those seeking mining rewards without technical expertise. However, this arrangement requires extraordinary trust in these operations. The Mining Max scandal exemplifies the risks, where operators allegedly diverted approximately $180 million from their $250 million investment pool for personal gain.

Cryptocurrency Fraud: The Dark Side of Digital Finance

In the evolving landscape of digital currencies, fraudulent schemes continue to plague investors and users alike. One notable case involved a mining company executive who admitted to orchestrating a $9 million fraud by overselling computational resources that didn't exist.

The intensive computational requirements for cryptocurrency mining have spawned a concerning trend: cryptojacking. This malicious practice involves hackers deploying trojan-based malware that hijacks victims' computing power to mine digital currencies without their knowledge or consent.

Several notorious cryptojacking programs have emerged in recent years. Social media platforms have become vectors for distribution, with malware like "digmine" spreading through messaging services. More sophisticated threats such as "wannamine" exploit high-level security vulnerabilities originally developed by government agencies.

Initial Coin Offerings (ICOs) represent another vulnerable area in the cryptocurrency space. Unlike traditional IPOs, these fundraising mechanisms often lack regulatory oversight, creating perfect conditions for scammers.

The typical ICO scam follows a predictable pattern: developers create elaborate technical documentation and make grandiose claims about their coin's potential and security features. After collecting substantial investments from hopeful buyers, the creators disappear with the funds.

The cryptocurrency community has witnessed several devastating exit scams. Notable examples include a digital currency project that accumulated $15 million before authorities intervened, and another venture whose team vanished with approximately $3-4 million of investor funds in early 2018.

Cryptocurrency Scams and Deceptions

The volatility of the cryptocurrency market, often leading to significant gains in short periods, can make it easier for scammers to promote pyramid or Ponzi schemes. These schemes are frequently seen as credible by unsuspecting investors who may not consider such returns as "too good to be true."

One notable example is the Austrian investment scheme Optioment, which lured investors with the promise of an incredible 4 percent weekly return. In the end, the scheme reportedly swindled over 12,000 bitcoins from its victims.

Another common scam involves fraudsters impersonating legitimate Initial Coin Offerings (ICOs). For instance, the Seele ICO had its Telegram channel hijacked by individuals posing as administrators. These imposters convinced investors to pay for tokens before the official sale began, and the funds were then stolen by the criminals.

Similarly, a phishing scam centered around the Bee Token ICO resulted in the loss of $1 million worth of ether. Scammers used deceptive tactics to trick investors into believing they were participating in a genuine ICO, only to divert their funds to fraudulent accounts.

Cryptocurrency Fraud Schemes: A Warning for Digital Asset Holders

Notable examples of questionable cryptocurrency operations have emerged over the years. Among these, Bitconnect ceased operations following legal challenges from regulatory authorities, while Onecoin continues to operate despite widespread allegations of running a sophisticated Ponzi structure with global reach.

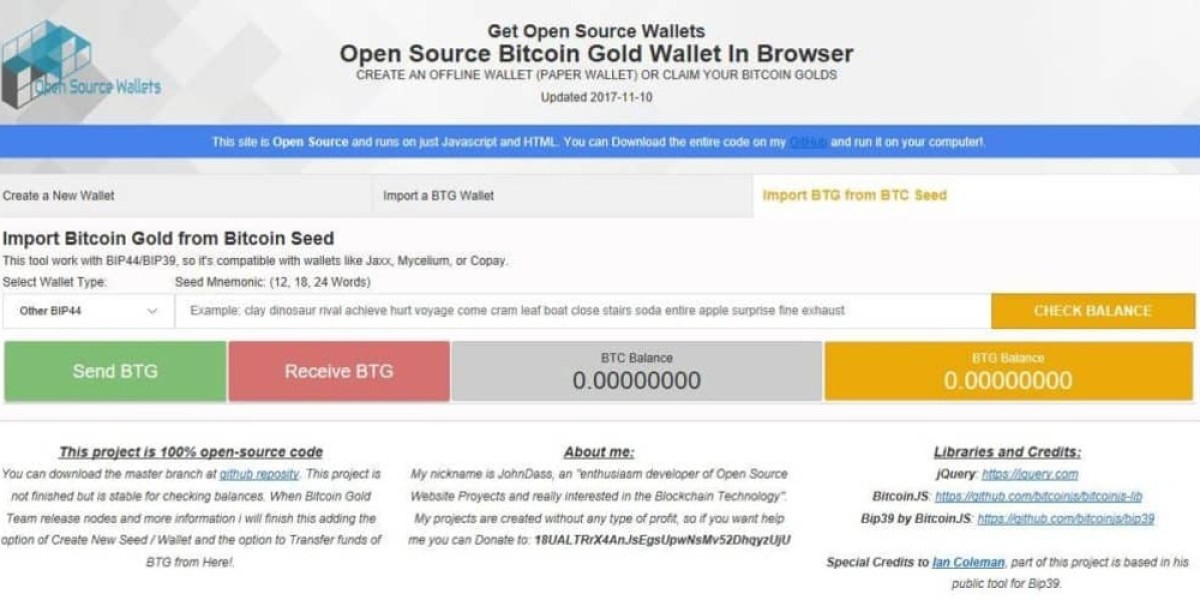

Digital currency storage presents another vulnerability for investors. Cryptocurrency wallets serve as digital vaults designed to protect the private keys that grant access to one's digital assets.

When blockchain networks undergo forks—creating new cryptocurrencies from existing ones—users often struggle to find legitimate wallet services supporting these new assets. This creates perfect opportunities for cybercriminals.

A prime illustration occurred following the Bitcoin Gold fork, when fraudsters launched mybtgwallet.com. This deceptive platform encouraged users to input their private keys under the guise of supporting the new cryptocurrency, ultimately resulting in theft of their holdings.

Cryptocurrency Scams: The Growing Threat of Digital Wallet Deception

In the rapidly evolving world of digital currencies, scammers continue to develop sophisticated methods to steal from unsuspecting investors. One particularly alarming trend involves the creation of counterfeit cryptocurrency wallets that mimic legitimate services.

A single fraudulent wallet operation recently caused investors to lose over $3 million in combined assets. This represents just one case in the expanding landscape of cryptocurrency deception.

The technique typically involves creating convincing replicas of established wallet interfaces. Users believe they're securing their digital assets in trusted platforms, when in reality, their cryptocurrencies are being diverted directly to criminals.

Perhaps the most notorious example comes from the cybercriminal collective known as Coinhoarder. This group orchestrated an elaborate scheme that netted approximately $50 million in stolen Bitcoin and other digital currencies. Their approach was particularly insidious, involving domain spoofing of the respected Blockchain.info service and strategic placement of Google advertisements to lure potential victims.

To further obscure their activities, perpetrators often utilize cryptocurrency mixing services. These platforms function by combining multiple transactions to disconnect the original sender from the final recipient, effectively anonymizing the movement of digital assets.

While mixing services like the formerly operational Helix by Grams and the still-active BitBlender can serve legitimate privacy purposes, they've increasingly become tools that enable fraudsters to launder stolen cryptocurrency, making recovery efforts extremely challenging for victims and authorities alike.

Cybercrime tactics constantly evolve to exploit digital trust

Fraudulent platforms mimicking trusted platforms often serve as data traps

extracting sensitive data through counterfeit forms during routine interactions

One notorious dark web scheme involved fake cryptocurrency tutorials

linking to cloned mixing service portals that siphoned funds automatically

unsuspecting users who complied with instructions lost assets permanently

Investment plagues mixing services too - Bitpetite offered 4% daily yields

despite mathematically impossible returns before exit scamming investors

vanished with millions while claiming to provide mixing infrastructure

Malicious popups remain prevalent beyond classic tech support cons

disguised as security alerts, these prompts deploy malicious payloads

compromising devices under the guise of antivirus installation

Counterfeit login pages continue dominating phishing strategies

perfectly replicating banking portals and cryptocurrency exchanges

harvesting credentials for immediate account takeover attacks

Cybercriminals and fraudsters employ a wide array of tactics to deceive their victims. One such method is the creation of fake websites, which can be incredibly convincing. For instance, a replica of a well-known brand's website, like those of Ugg, Coach, or Michael Kors, can trick consumers into believing they are purchasing authentic products from the genuine company.

Another prevalent scam involves dating and romance. These schemes have been around for a long time and continue to cause significant financial losses, particularly in the United States. Scammers often reach out to potential victims through various channels, including phone, email, text, social media, and dating sites. They may create false profiles (a practice known as catfishing) and work in groups to manipulate their targets. The ultimate goal is to extract money, personal information, or even involve the victim in illegal activities.

Ticket scams are also common, affecting not just travelers but also concertgoers and sports fans. Victims purchase tickets online, only to find out at the event that the tickets are counterfeit.

Rental scams target individuals who are urgently seeking a place to live. Advertisements for rental properties with unusually low prices attract many potential tenants. The fake landlords, claiming to be overseas, offer refunds if the tenant is unsatisfied. However, they require the first and last month's rent upfront, and may also ask for banking details and other personal information.

SMS scams, or smishing, are another form of phishing where scammers use text messages. These messages often contain links to download malware or lead to phishing pages designed to steal login credentials. Other texts might provide a number to call, transitioning the scam to a vishing (voice phishing) scheme. Common SMS scams include attempts to get the victim to activate a new credit card or inform them of an expiring account.

In more elaborate schemes, scammers target Amazon customers who purchase items from third-party sellers. When the item does not arrive, the seller encourages the buyer to complete the transaction outside of Amazon, thereby gaining access to payment information. In another variation, the seller ships empty packages to incorrect addresses, where they are signed for by someone involved in the scam. This makes it difficult for the victim to file a claim with Amazon.

Astroturfing, a deceptive marketing tactic, involves companies creating fake support for their products. A famous example is McDonald’s paying employees to queue for the release of the Quarter Pounder in Japan. In the digital age, this has evolved into fake online reviews. Companies pay individuals to write positive reviews on supposedly unbiased platforms, and there are even Facebook groups dedicated to exchanging reviews for specific sites like Amazon or for particular product types, such as books.

Navigating the Digital Minefield: Understanding Online Deception Tactics

In today's digital marketplace, consumer decisions are heavily influenced by online reviews, often leading to disappointment when products fail to meet expectations or, worse, never arrive at all.

Subscription traps represent a common deceptive practice online. These typically begin with enticing pop-up advertisements offering complimentary gifts or discounted items. Victims provide payment card information for nominal shipping fees, unknowingly agreeing to recurring monthly charges buried in fine print. Cancellation processes are deliberately complicated, frequently requiring direct intervention with financial institutions to terminate payments. Unfortunately, refunds for previous charges are rarely successful.

Regular review of account statements is crucial for identifying these unauthorized recurring charges before they accumulate significantly.

Market manipulation schemes operate openly through various communication channels. These involve publishing misleading content designed to attract investment based on unrealistic projections. Regulatory agencies actively monitor such activities, as evidenced by recent SEC actions against individuals disseminating false stock information on social media platforms.

Online selling platforms present unique vulnerabilities for merchants. A prevalent scheme involves buyers sending counterfeit payment confirmations, claiming funds will be released upon receiving shipping verification. Once goods are dispatched, the promised payment never materializes.

Another tactic targeting sellers is the deliberate overpayment scheme. After sending excessive payment for purchased items, scammers request refunds for the difference. Subsequently, they cancel their original payment, leaving sellers with financial losses after having issued partial refunds.

As digital fraud methods continuously evolve, recognizing warning signs becomes essential for protection.

Fraudulent operations frequently rely on convincing website replicas to harvest personal information. With domain registration and website creation becoming increasingly accessible, distinguishing legitimate sites from imitations presents challenges.

Protection strategies include technical verification methods such as confirming URL authenticity and broader assessments like examining contact information quality and overall site professionalism. While no single indicator guarantees website legitimacy, combining multiple verification approaches enhances decision-making accuracy.

Prevention remains the most effective defense against online deception. When encountering suspected fraud, promptly report incidents to relevant platform administrators to prevent further victimization.

Depending on circumstances, contacting local law enforcement may be appropriate, particularly in cases involving financial loss, coercion into illegal activity, or extortion attempts.

National fraud reporting centers provide additional resources:

• United States: FBI Internet Crime Complaint Center

• Canada: Canadian Anti-Fraud Centre

• Australia: ACCC Scamwatch

• United Kingdom: Action Fraud

Though victims often hesitate to report incidents due to embarrassment, increased reporting strengthens enforcement capabilities and raises public awareness about evolving digital threats.

What is a Netflix VPN and How to Get One

A Netflix VPN is a specialized virtual private network service that enables viewers to bypass geographical restrictions on streaming content, allowing access to different regional Netflix libraries from anywhere in the world. When using a Netflix VPN, subscribers can connect to servers in various countries to unlock shows and movies that might otherwise be unavailable in their location due to licensing agreements. This technology has become increasingly popular among international travelers and content enthusiasts who want to maintain access to their favorite Netflix programs regardless of where they physically reside.

Why Choose SafeShell as Your Netflix VPN?

If people want to access region-restricted content by Netflix VPN, they may want to consider the SafeShell VPN . 1. SafeShell VPN offers high-speed servers specifically optimized for seamless Netflix streaming, ensuring buffer-free and high-definition playback. 2. It allows you to connect up to five devices simultaneously, supporting a wide array of operating systems such as Windows, macOS, iOS, Android, Apple TV, Android TV, and Apple Vision Pro, making it easy to enjoy your favorite content on any device. 3. The exclusive App Mode feature lets you unlock and enjoy content from multiple regions at the same time, providing access to a diverse range of streaming services and libraries. 4. With lightning-fast connection speeds and no bandwidth limitations, SafeShell VPN ensures a smooth and unrestricted streaming experience. 5. Top-level security is a priority with the proprietary "ShellGuard" protocol, offering advanced encryption and robust security features to protect your data. 6. Additionally, SafeShell VPN provides a flexible free trial plan, allowing users to explore its robust features without any commitment, making it an excellent choice for those looking to Netflix unblocked with both security and convenience.

A Step-by-Step Guide to Watch Netflix with SafeShell VPN

To start using SafeShell Netflix VPN , the first step is to subscribe to the service. Visit the official SafeShell VPN website and select a plan that suits your needs and budget. Once you have chosen your plan, click on the "Subscribe Now" button to complete the subscription process. This will provide you with the necessary credentials to access the service.

Next, download and install the SafeShell VPN app on your device. Go to the SafeShell VPN website and select the appropriate version for your device, whether it's Windows, macOS, iOS, or Android. After downloading the app, install it and launch it. Log in to your account by clicking on the "Log In" button. SafeShell offers two modes, but for the best Netflix experience, choose the APP mode.

Once logged in, you can now select the server location. Browse through the list of available servers and pick one that corresponds to the region whose Netflix content you want to access, such as the US, UK, or Canada. Click on "Connect" to establish a connection to the chosen server. Finally, open the Netflix app or visit the Netflix website, log in with your Netflix account, and start streaming the content available in the region you selected. Enjoy your enhanced viewing experience with SafeShell Netflix VPN.